The GST Credit is an essential program for Canadians with low to moderate incomes, offsetting the goods and services tax (GST) or harmonized sales tax (HST) they pay. Understanding the 2025 updates can help you maximize your benefit and reduce financial stress.

Whether you’re newly eligible or looking to confirm your payment, it’s crucial to know the criteria, estimated amounts, and the automatic registration process. Let’s break it all down!

What Is the GST Credit?

The GST Credit is a tax-free payment issued by the Canada Revenue Agency (CRA). It aims to support Canadians by reducing the financial impact of GST/HST paid on everyday purchases.

Payments are made quarterly, providing supplementary income to help cover essentials like groceries, utilities, or transportation. Unlike a tax refund, the GST Credit assists even those with little to no income.

Who Qualifies for the 2025 GST Credit?

Eligibility is assessed through your 2024 tax return. The CRA evaluates several factors, including your residency, age, and adjusted net family income.

- Residency: You must live in Canada during the month before and at the start of the payment month.

- Age: Be 19 or older, or have a spouse, common-law partner, or dependent child living with you.

- Income Thresholds: Your family’s adjusted net income must fall below maximum limits, which vary by family size.

Newcomers to Canada or individuals not filing taxes must manually register for the benefit, as detailed further below.

Income Thresholds for 2025

Your eligibility is determined by your family composition and income level. Below is a table showing approximate income limits for 2025:

| Family Composition | Maximum Income Threshold |

|---|---|

| Single individual | $54,704 |

| Single with 1 child | $62,544 |

| Single with 2 children | $70,384 |

| Married/common-law couple | $69,015 |

| Couple with 2 children | $84,695 |

How Much Could You Receive?

The CRA calculates your GST Credit based on your income and family size. Amounts for the 2025 benefit year are as follows:

- $533 for a single person (19 or older)

- $698 for married or common-law couples

- $184 per dependent child under 19

As your income nears the upper eligibility threshold, your quarterly payment will be proportionally reduced until it is phased out entirely.

How to Apply for the 2025 GST Credit

The good news? Most Canadians don’t need to apply! Filing your 2024 tax return automatically enrolls you for the 2025 GST Credit.

What to Do in Special Cases

In some scenarios, manual applications are required:

- New to Canada: Complete Form RC151 to register as a new resident if you don’t have children. Families with children can use Form RC66.

- Had a Baby: Inform CRA to claim additional amounts for your new child by updating your CRA My Account.

When Will Payments Be Made?

Payments for 2025 will be issued on the following dates:

- July 5, 2025

- October 4, 2025

- January 5, 2026

- April 4, 2026

Direct deposit ensures faster payment, while non-enrolled recipients will receive checks by mail.

Expert Tips to Ensure Maximum Benefits

Consider these tips to get the most out of your GST Credit payments:

- Always file your taxes, even if you have no income

- Keep contact information updated in CRA My Account

- Double-check your Notice of Assessment for credit amounts

- Inform CRA immediately of family or marital status changes

- Set up direct deposit for quicker payments

How Does the GST Credit Impact Canadians?

For struggling families, the GST Credit offers significant relief. For example, a single parent earning $45,000 and raising two children could receive approximately $900 annually. That offsets key expenses like utilities, transportation, or grocery bills.

Check if You’re Eligible for the 2025 GST Credit

Don’t miss out on financial support! Verify your eligibility by filing your 2024 return or logging into CRA My Account today. Every dollar matters when managing your household budget.

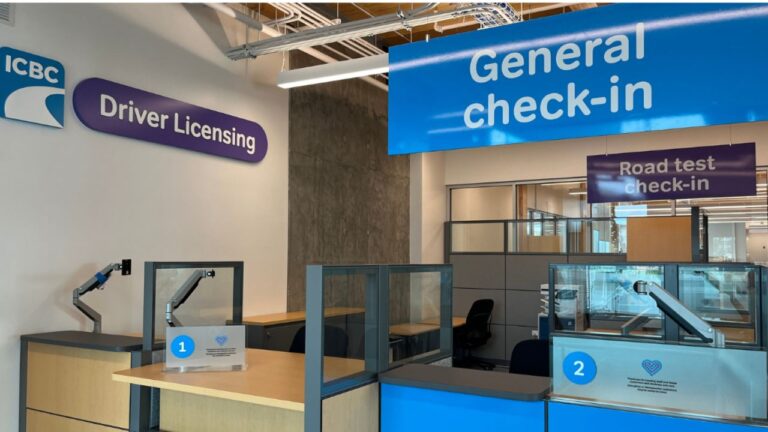

Navigating British Columbia's driver licensing with ease is possible! Learn essential steps for getting, renewing, or replacing your licence—book your ICBC appointment today!

👉 Continue Lendo.. Clique aqui